In the ever-changing world of financial markets, brokerages serve as essential intermediaries between traders and liquidity providers. As market volatility and regulatory challenges increase, brokerages face growing pressures to manage risks and maintain stable operations. This is where hedging becomes critical. In this article, we will explore the importance of hedging for brokerages, the advantages of adopting a hybrid execution model, and how a Liquidity Bridge functions.

Why Do Brokerages Need Hedging?

Brokerages operate in a competitive and volatile market, where fluctuations can pose significant financial risks. Hedging provides an effective strategy to manage these risks, protect client positions, and enhance profitability.

By hedging their positions, brokerages can mitigate potential losses from unfavorable market movements, ensuring that sudden price fluctuations do not deplete their capital. This allows brokerages to preserve stability and continue operating smoothly even during periods of market uncertainty.

A-Book Execution

In the A-Book model, brokerage positions are directly routed to liquidity providers or the open market. This method is best for high-quality traders whose trades can be matched with external liquidity sources. A-Book execution reduces the broker’s exposure to risk by transferring trades to external liquidity providers.

B-Book Execution

In contrast, the B-Book model sees the brokerage acting as the counterparty to client trades, handling all the risks internally. While this method is cost-effective, it comes with drawbacks, as the broker assumes the risk of clients’ positions. As a result, the brokerage’s profits often come from traders' losses.

C-Book Execution

To optimize hedging strategies, brokerages often implement a hybrid execution model (C-Book). This model combines two execution methods, A-Book and B-Book, to create a balance between risk management and revenue generation.

By combining both execution models, brokerages can find a balance between managing risk and generating revenue. The hybrid approach allows firms to serve a broad range of traders while effectively controlling overall risk exposure.

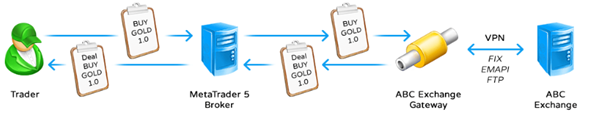

Enhancing Hybrid Execution with Liquidity Bridge

When it comes to hedging, understanding how a Liquidity Bridge operates is crucial. A Liquidity Bridge is a technology solution that links brokerages with multiple liquidity providers, streamlining execution and risk management.

Aggregation of Liquidity

A Liquidity Bridge aggregates liquidity from various sources, ensuring competitive pricing, market depth, and consistent execution for both the brokerage and its clients.

Real-time Risk Management

Liquidity Bridge solutions include built-in risk management tools that can help brokers avoid issues such as server crashes during live trading. These tools also allow brokerages to actively manage risks and effectively hedge their positions.

Flexible Order Routing

With a Liquidity Bridge, brokerages can customize order routing rules based on predefined criteria. This flexibility enables firms to prioritize certain liquidity providers, manage specific order types, and reduce price slippage, thereby optimizing profitability.

Reporting and Analytics

Liquidity Bridge platforms offer detailed reporting and analytics capabilities. Brokerages can access trade execution data and performance reports, empowering them to make informed, data-driven decisions while enhancing transparency.

Conclusion

Hedging has become an indispensable tool for brokerages to manage risk and optimize profitability in today’s dynamic financial markets. By incorporating effective hedging strategies, adopting a hybrid execution model, and leveraging advanced technologies like the Liquidity Bridge, brokerages can confidently navigate market uncertainties. Properly implemented hedging practices ensure operational stability, foster trust with clients, and strengthen a broker’s position in the competitive marketplace. For brokerages aiming for sustainable growth and long-term success, hedging is a foundational element that will drive them forward.

With years of experience in the financial market, Azy Prime has gained huge industry insight and experience to integrate different bridges with MT4/5 platforms.