Whether you're launching a new brokerage or optimizing an existing one, the right technology can define your success. In a fast-moving market, tools are not just add-ons — they are the foundation of sustainable growth and long-term competitiveness.

A Variety of Tools for Brokers

In today’s highly competitive financial services landscape, the success of a brokerage depends not only on its trading platform but also on the strength, flexibility, and scalability of its supporting infrastructure. Tools for brokers go far beyond basic order execution — they include comprehensive solutions for risk management, liquidity aggregation, reporting automation, AI-powered analytics, and seamless integration with CRM, payment systems, and compliance platforms.

The evolution of trading has made client expectations more demanding. Traders now expect lightning-fast execution, transparent pricing, real-time analytics, and personalized support — all in one seamless experience. To deliver on these demands, brokerages must operate like technology companies, leveraging smart tools to remain agile, efficient, and compliant.

Today’s broker toolkit is diverse. It includes:

- Analytics tools for brokers, which provide actionable insights into trader behavior, risk exposure, order flow, and performance metrics. These tools empower brokers to make faster, data-driven decisions and identify opportunities or threats in real time.

- Broker dealer tools, which support regulated operations through features like trade surveillance, audit trails, investor profiling, and compliance reporting — critical for meeting increasingly complex legal requirements.

- AI tools for mortgage brokers, helping digitize the loan application process, automate document verification, predict borrower risk, and offer tailored mortgage recommendations — all while reducing manual work.

- Forex broker tools, such as liquidity bridges, quote aggregators, slippage protection, order routing systems, and plugins for managing swaps and spreads. These are essential for maintaining a competitive edge in the fast-paced FX market.

- Broker tools that cover the broader tech ecosystem — including monitoring tools, customer support automation, fee managers, bonus systems, and integrations with external fintech services.

- Best online broker trading tools, such as real-time charting, API access, algorithmic strategy testing, and mobile trading platforms — all essential for client acquisition and retention.

- Tool brokers — providers that specialize in delivering, customizing, and supporting these advanced solutions for the broker community.

Simply put, brokers with the best tools have a clear advantage. Their operations are smoother, their clients are more satisfied, and their margins are stronger.

Tools for Brokers from Takeprofit Tech

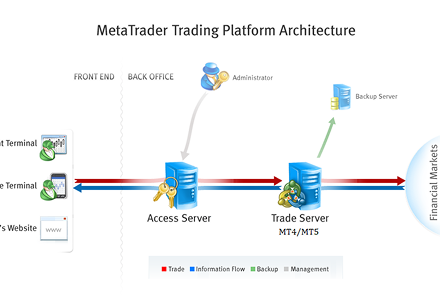

One of the most recognized names in the broker tooling space is Takeprofit Tech — a software development company specializing in powerful, modular tools built for MetaTrader 4, MetaTrader 5, and custom trading platforms. The company serves brokers around the world by providing them with fast, reliable, and scalable technology designed to meet the unique challenges of today’s markets.

Establishing a business

For new brokers entering the market, Takeprofit Tech offers a suite of tools that simplify and accelerate the setup process. This includes liquidity aggregation solutions, risk management modules, quote feeds, and a range of plugins for MetaTrader servers. These tools reduce time to launch while providing the foundation for future growth. Beyond infrastructure, the company helps new brokers with automation tools to reduce manual workload — such as auto-withdrawals, daily reporting, and alerting systems. With these systems in place, startups can focus on marketing, acquisition, and client support rather than building internal tech stacks from scratch.

Scaling company

Once a broker is operational, the next challenge is scaling. Growth introduces complexity — more clients, more volume, and higher operational risk. Takeprofit Tech addresses this with solutions like margin controllers, slippage protectors, liquidity management dashboards, and data-driven risk engines. These tools are built to handle enterprise-grade volumes while maintaining performance and uptime. Moreover, their modular nature means brokers can upgrade or expand their tech stack without disrupting existing workflows — a must-have for companies operating in multiple markets or jurisdictions.

Distinguishing among competitors

In a saturated brokerage market, differentiation is critical. Takeprofit Tech offers a competitive edge by allowing brokers to create unique experiences for their clients. This includes custom plugins, automation logic, and user-facing features such as copy trading systems, social trading modules, bonus engines, and referral tracking systems. By customizing how services are delivered, brokers can better align with the needs of their target audience — be it retail traders, high-frequency scalpers, or institutional partners. This flexibility helps elevate brand perception and client loyalty.

Dealing with big business

Large-scale brokerage operations — including institutional-facing brokers or liquidity providers — face unique challenges. From onboarding VIP clients with tailored trading conditions to ensuring execution transparency and managing server loads, enterprise brokers require robust tools that don’t break under pressure. Takeprofit Tech’s solutions are engineered for this environment. With FIX protocol support, custom bridge configurations, big-data analytics, and trade reconciliation systems, brokers can serve demanding clients while maintaining full control over operations. Furthermore, reporting and compliance modules help brokers meet international regulatory standards — a crucial component for expanding globally or securing partnerships with banks and financial institutions.

Closing Statements

The brokerage industry is undergoing rapid transformation. Automation, personalization, and compliance are no longer optional — they’re integral to survival. In this new reality, having access to reliable and scalable tools for brokers is a key factor in maintaining competitiveness. Whether you’re building a brokerage from the ground up or optimizing an existing business, investing in technology is a strategic decision. With the right tools, brokers can improve their operational efficiency, reduce costs, attract high-value clients, and ultimately — grow sustainably.

Forward-looking brokers are turning to providers like Takeprofit Tech for modular, customizable, and proven solutions that evolve with the market. As regulatory pressure increases and traders become more tech-savvy, success will depend not just on offering trades — but on offering a seamless, secure, and intelligent trading ecosystem. In conclusion, brokers with the best tools will continue to lead the pack. Their agility, performance, and client satisfaction will set new standards in the financial services industry.

FAQ on Tools for Brokers (FAQs)

Trading platforms like MT4 and MT5 are limited in scope. Additional tools enable automation, liquidity management, compliance tracking, risk control, and integration with other systems — all essential for modern brokerage operations.

First, identify core business goals: scalability, compliance, client experience, or cost reduction. Then select vendors with a proven track record, transparent support, and flexible integration options. Avoid one-size-fits-all solutions — customization is key.

While many tools are optimized for MT4 and MT5, leading providers now offer platform-agnostic solutions. This includes support for cTrader, custom-built platforms, and FIX-based ecosystems. The best tools are flexible enough to evolve with your infrastructure.