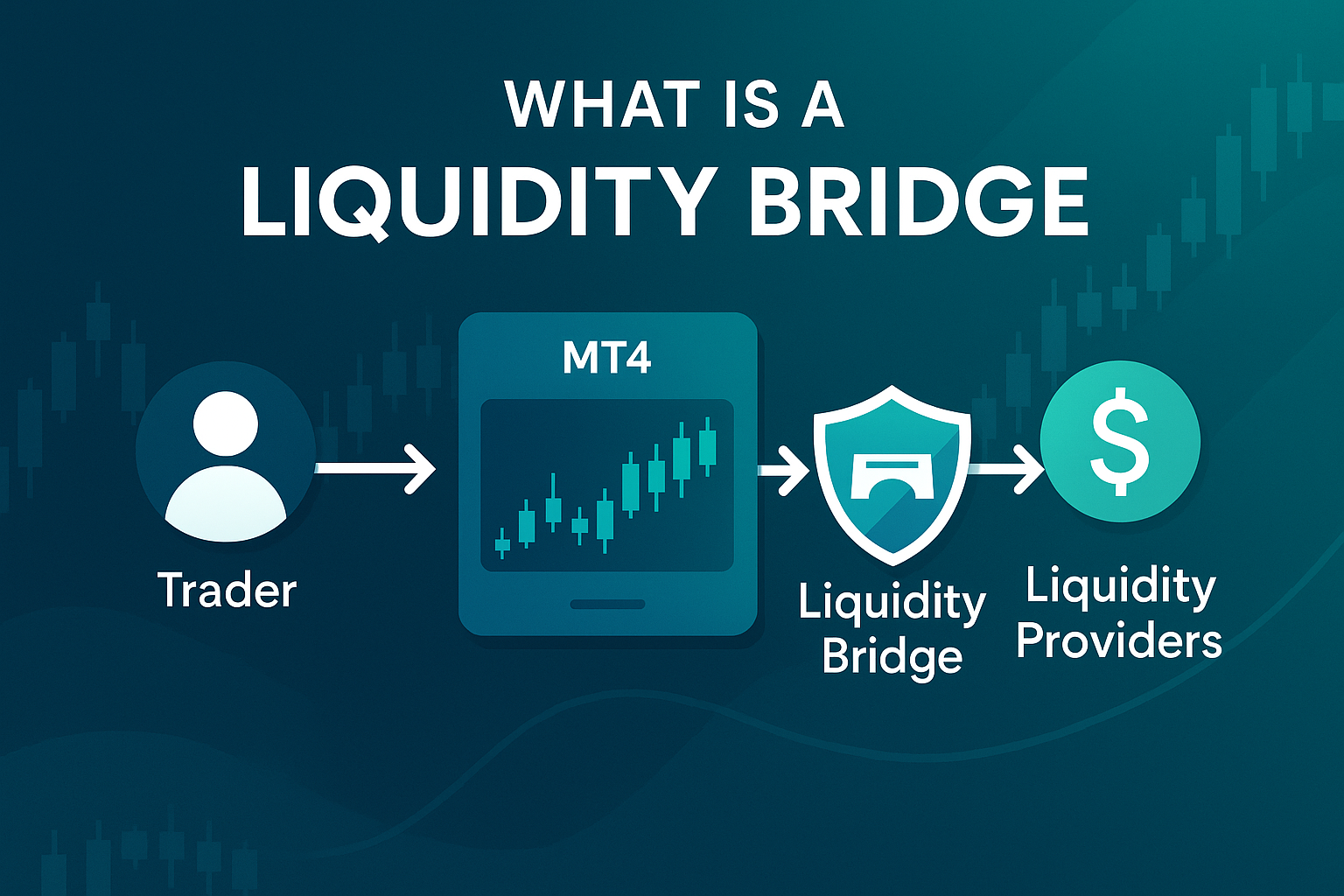

In the fintech-trading environment, there are many concepts that at first seem overly technical, obscure. One of those terms – liquidity bridge. But it’s worth digging in a little, and everything becomes logical: this is a very specific instrument that plays a crucial role in brokers’ trading infrastructure.

So, what is a liquidity bridge? It is an intermediary component that forms a “bridge” between the broker’s trading platform and liquidity providers (banks, market-makers, other brokers). It takes clients’ requests (to buy or sell), passes them to liquidity providers, receives responses (best prices, volumes), and then sends them back to clients. This “little bridge” is a key element in a company’s technological architecture that strives to ensure live, fast, and low-cost access to the market.

In this text, we will consider several subtleties: why it is needed, what types exist, and what you have to deal with.

Bridge liquidity meaning in trading

Imagine a situation: a client enters the platform, clicks “buy EUR/USD”, and there… no liquidity provider received the request, or received it with a delay, or replied “insufficient volume.” In the best case, there will be a long queue; in the worst – slippage, huge spreads, or simply refusal to execute.

Here, the role of the broker liquidity bridge emerges. Its purpose – to minimize time between client and liquidity, correctly route requests, pick among several offers the best one. Thanks to this, the client sees competitive quotes, and the broker risks less being “left with unfilled requests.”

What does this give in practice? First, less slippage – prices closer to market. Second, higher execution speed. The client does not wait several seconds, but sometimes milliseconds. Third, competition among liquidity providers. If one gives worse prices, the system will switch to another. And of course, flexibility in scaling: you can connect new providers, change the chain of routes, and improve algorithms.

Now, when MT4 liquidity bridge or MT5 liquidity bridge is mentioned, it means implementation of that bridge specifically for MetaTrader 4 or MetaTrader 5 platforms, taking into account protocol peculiarities, messages, request/response formats. Sometimes, in a broader context, the MetaTrader liquidity bridge is used – a universal name for such integrations. If the topic is cryptocurrencies – crypto liquidity bridge – a bridge between decentralized exchanges and traditional brokers or market-makers.

What are the main types of liquidity bridges?

There is no “one template” that would suit everyone. Different architectures, approaches – depending on the broker’s strategy, region, support of protocols. Here are the most widespread.

Electronic communication network (ECN) liquidity bridge

This type of liquidity bridge functions as a true electronic marketplace, where limit orders from traders are placed alongside those of banks and other market participants. Clients can see quotes from multiple providers simultaneously – similar to how it works on an exchange. Instead of routing orders directly to a single liquidity provider, ECN bridges aggregate orders into a transparent order book, allowing matching between participants.

Among liquidity bridge types, ECN is often referenced when discussing the liquidity bridge definition in a narrow, market-neutral context.

Features:

- transparent order book – traders can view market depth and best bid/ask prices;

- traders are matched between participants, not just executed against a provider;

- no dealing desk – pure market execution model;

- requires advanced infrastructure and high-speed connectivity;

- may be more complex to manage during high volatility due to fluctuating volumes.

This model is commonly used by brokers who serve institutional or professional traders and who prioritize execution transparency and direct market access.

Straight-through processing (STP) liquidity bridge

STP liquidity bridge is a technology that automatically forwards client orders to external liquidity providers without manual intervention. Unlike ECN, there is no central order book or matching between clients – the system simply routes market orders to one or more pre-configured liquidity providers based on certain rules.

This model does not display order depth but offers efficient and fast execution, typically with lower infrastructure demands than ECN.

Key traits:

- automated routing – no manual dealing or internal execution;

- no order book – execution is done directly with a liquidity provider;

- routing logic may include volume thresholds or prioritization of certain providers;

- lower latency due to simplified execution chain;

- suitable for brokers with less complex infrastructure or retail focus.

However, execution quality may depend on the responsiveness and pricing of the selected liquidity providers. In cases where one provider offers tight spreads but small volumes, the system may shift orders to less favorable providers under load.

The risks and challenges of liquidity bridges

Any technology working in real time has a range of critical zones, and the liquidity bridge is no exception. Everything matters: server quality, correct configuration, counterparty behavior.

Dependency on technical infrastructure

Everything works while the internet, servers, data-centers, and routers work. Once something falters, the bridge begins to “slip.” This is one of the most insidious challenges: the system seems configured, tested, but in real circumstances, something constantly interferes – lags, time-outs, hangs.

The most vulnerable technical components:

- Network connection between the trading server and the bridge. If latency exceeds 100-150 ms, the risk of slippage is already there.

- Physical location of servers. Broker targets traders from Asia, and the server sits in Frankfurt? Well, hello delays during peak hours.

- Availability of liquidity providers. In some cases, the channel to the provider goes through VPN, and if that “dips” – the whole system slows.

- Error handling. If the infrastructure does not allow a fallback (reserve channel), when one component fails, everything simply stops.

And here one must do more than buy a powerful server; one must have monitoring that reads even the smallest glitches. If latency has grown by 10 ms, better to know about it before complaints from traders start.

Misconfiguration and human error

Even the best bridge becomes “a bottleneck” if misconfigured. And most often issues are not in code, not in hardware, but in human factor.

Typical mistakes include poor provider prioritization, missing timeouts, incorrect volume limits, and insufficient logging. Sometimes, after an update, required modules aren’t activated – the bridge is “on” but not working. Traders usually notice first. Properly configured liquidity bridge solutions for brokerage help prevent these operational blind spots.

Liquidity provider reliability

Typically, the technical specifications for building a bridge mention the names of large liquidity providers: banks, ECN networks, and large hubs. However, even if a counterparty seems reliable, that does not guarantee stable operation. Liquidity can dry up at night or during major news; quotes may come with delays of 300-400 ms, making the order irrelevant. Sometimes providers go down for maintenance without warning, or abruptly change terms due to regulations.

Compliance challenges

Legal requirements – no less important than technical. And here the situation is even more complex: regulations change, new demands appear for AML, KYC, logging, data retention, routing. And also, jurisdictional specifics: in the EU, Asia, or the UAE – different approaches. Problems with compliance can occur at the following levels:

- Storing trading logs. Regulator demands a log of all requests for 5 years. If the bridge does not store – that is already a violation.

- Cross-border transaction control. If the client is from Iran and bridge – in the EU, there may be violations of the sanctions policy.

- Insufficient error logging. Regulator checks whether the broker knew of failures. And the broker didn’t know, because the log file was disabled.

- Integration with fraud control systems. If the bridge does not support integration with relevant systems, that is a violation of security rules.

In some countries, brokers are required to retain the processing time of each order, down to milliseconds. And if this is missing, even a minor violation may lead to license loss.

The rise of crypto trading adds another layer of complexity. With liquidity bridge crypto solutions connecting decentralized exchanges and traditional platforms, regulatory oversight becomes even more critical, especially when bridging assets across jurisdictions with differing legal frameworks.

Scaling challenges

A bridge that performs well with 1,000 clients may struggle to handle the demands of 10,000 users. This is not hypothetical, but a daily reality of fast-growing brokers. The primary difficulty of scaling is the increase in request volumes. When more traders than expected, the server simply cannot process all trading requests.

Another is overfilled queues. Many bridges have queue capacity limits. If it is full, new requests are either ignored or dropped. Problems with load balancing are also common. For example, one provider gets 90% of requests, and others “rest.”

What else? Inefficient architecture. If the bridge is built monolithically, without the possibility of horizontal scaling, when growth happens, one must basically rewrite the system. And finally, insufficiently flexible routing algorithms. They do not keep up adjusting to load changes in real time.

So, bridge liquidity is not just a software or API connection, but a dynamic, load-sensitive system that requires stability, flexibility, and constant refinement. That is why Azy Prime, specializing in development and support of infrastructure for MetaTrader, becomes a key partner for brokers aiming to scale without risking loss of quality.