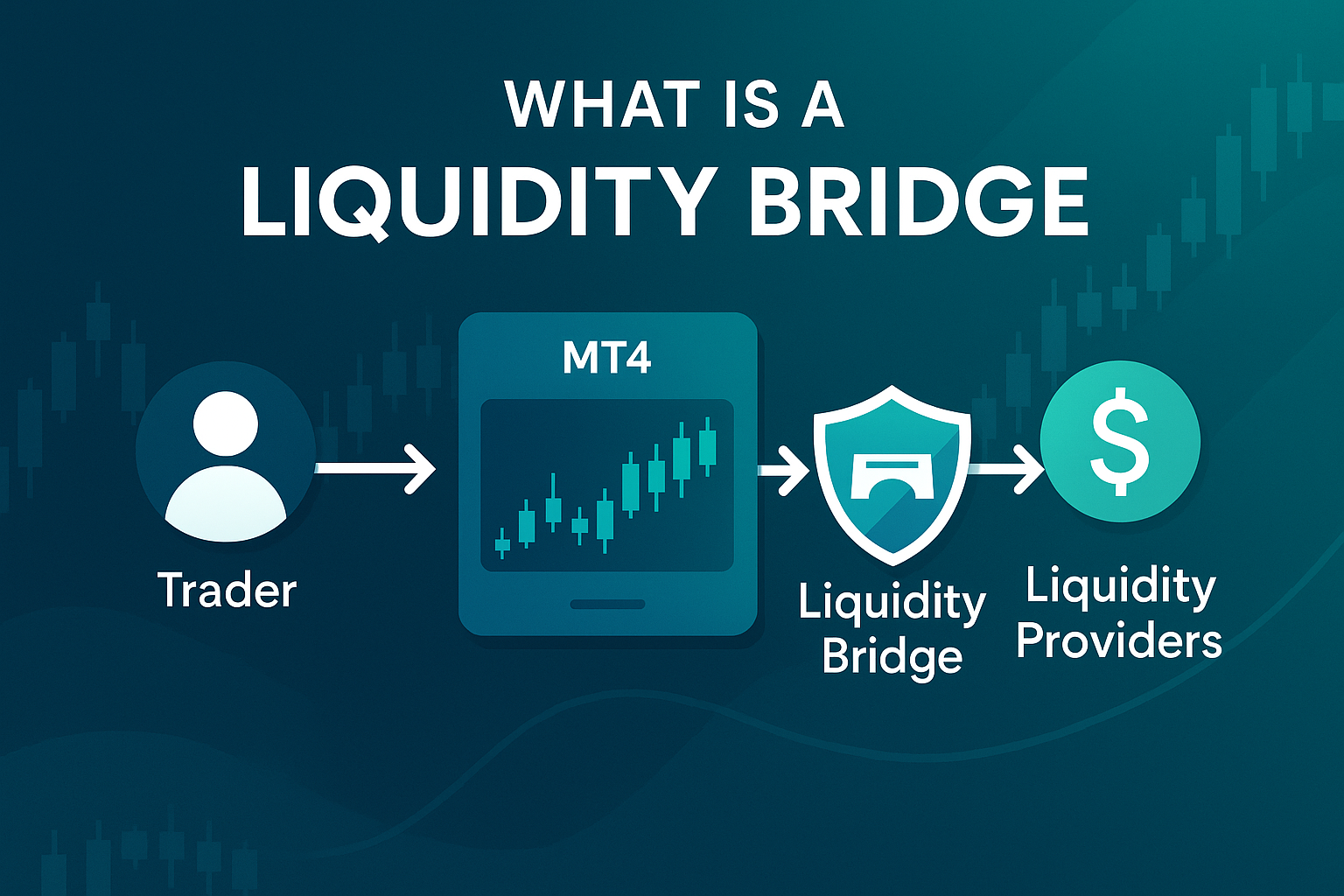

In forex trading, speed and reliability can make or break a deal. Brokers need a solid connection to liquidity providers, and that’s where a bridge forex becomes essential. Not all bridges deliver the same level of performance, so understanding what sets a good one apart helps avoid costly mistakes.

MetaTrader bridge

A MetaTrader bridge serves as a crucial intermediary between MetaTrader platforms and the liquidity pools provided by brokers and market makers. MetaTrader, both the MT4 and MT5 platforms, is a standard in the industry. Still, these platforms themselves don't natively support advanced liquidity connections or aggregations, which is where the forex bridge comes in. In fact, it translates MetaTrader’s native trade data into a format that external liquidity providers can understand.

For brokers, the integration allows seamless execution of trades on the MetaTrader platforms while pulling liquidity from external pools, thus providing better execution and tighter spreads. It's about performance – lower latency and higher reliability mean that traders can execute orders with a higher probability of success.

The difference between forex bridge provider MT4 and forex bridge provider MT5 lies mostly in the platform architecture and capabilities. MT5, being newer, supports more order types, hedging options, and generally better execution protocols, but some brokers remain loyal to MT4 for its simplicity and vast user base. The bridge has to fit these platform nuances perfectly.

Things to consider when choosing a forex bridge provider

When selecting a forex bridge provider, many variables matter. Skipping them can cost in lost trades, unhappy clients, unexpected downtime. Below is a structured list of key points.

How fast is the MetaTrader bridge you consider?

Speed is paramount. A sluggish bridge means delayed order execution, price slippage, and potentially lost trades. Especially during volatile market hours, a fraction of a second delay can impact profitability dramatically.

If the bridge isn’t optimized for low latency, it’s like driving a racecar on a gravel road.

Is the tech support of the bridge provider good enough for you?

No matter how robust the FX bridge may be, issues can – and will – arise. So, what’s more important than just the functionality of the system? The tech support you’ll have when something breaks down.

- Is support available 24/7?

- Does the provider offer direct access to experienced technical staff?

- What do user reviews say about their support service?

When something goes wrong – whether it’s a connection issue, a lag in execution, or a configuration error – the downtime costs can add up fast. A good provider will make troubleshooting easier and faster.

How many LPs does the bridge support?

The number of liquidity providers (LPs) your bridge can connect to significantly influences pricing competitiveness and execution quality. More LPs mean more pricing options, potentially better spreads, and less risk of a single LP outage.

However, it’s not just quantity but quality:

- Are the LPs reputable and reliable?

- Is the bridge able to aggregate prices effectively?

- Can it handle complex routing rules (e.g., volume-weighted routing)?

Here’s a quick checklist to evaluate LP support:

- number of integrated LPs;

- types of LPs (banks, ECNs, market makers);

- aggregation capabilities (does the bridge pick the best price automatically?);

- redundancy and failover mechanisms.

Without enough diverse LP connections, the fx bridge risks becoming a single point of failure or a bottleneck.

What aggregation features does the bridge provider offer?

Aggregation isn’t merely about pulling prices from various sources – it’s about smart handling of that data. How does the bridge merge multiple feeds? Does it simply pick the best bid and offer, or does it use algorithms to minimize risk and reduce slippage?

Look for features like:

- volume-weighted average pricing (VWAP);

- smart order routing to the best LP in real time;

- partial order filling and reallocation;

- filtering out stale or erratic prices.

These capabilities can mean the difference between a functional tool and one that actively improves your trading results.

What is the price of the bridge?

Pricing models for bridges vary. Some providers offer flat fees, others charge per order, and some have licensing based on trading volume. While cost is crucial, the cheapest option isn’t always the best.

Things to keep in mind about price:

- Are there hidden costs, like fees for adding new LPs or support?

- Is the pricing scalable if trading volume grows?

- What’s included in the price – updates, maintenance, support?

Also, a trade-off between price and quality of service. Sometimes paying a bit more upfront avoids expensive downtime and headaches later.

Forex bridge from AzyPrime

Among the various forex bridge providers, AzyPrime stands out as a top choice for many brokers. Known for its reliability, speed, and extensive support, AzyPrime’s MetaTrader bridge is designed to cater to both novice and experienced brokers alike.

Key offerings of AzyPrime MetaTrader bridge forex

AzyPrime’s approach to the forex bridge provider MT5 and MT4 markets emphasizes five pillars that shape broker success.

Risk management

Risk is the constant companion of any broker. AzyPrime understands this well. So, the bridge provides:

- real-time exposure monitoring;

- automatic hedging and stop loss triggers;

- limits on trade sizes and volumes per LP.

These tools help keep dangerous positions in check without manual intervention.

Flexible rule settings

AzyPrime offers flexible rule settings, allowing brokers to customize how trades are handled based on specific strategies, risk appetites, or market conditions. This feature helps brokers provide a tailored experience for their clients while still maintaining control over the overall risk.

Wide aggregation opportunities

Aggregation is a key element in providing competitive pricing. AzyPrime excels here by offering multiple liquidity sources that can be aggregated in real-time, ensuring that brokers always have access to the best available price from their liquidity providers.

White-label friendliness

AzyPrime’s forex bridge solution is perfect for brokers who want to offer a white-label solution to their clients. The bridge can be easily branded with the broker’s logo and customized to meet specific needs.

24/7 support

Forex never sleeps, and neither does AzyPrime’s support team. Brokers have peace of mind knowing help is always a call or message away.

Order a demo of the forex bridge

Curious about how these systems really work? Most providers, including AzyPrime, offer demos. It’s one thing to read specs; it’s another to see live order flow, check response times, and test connectivity firsthand.

Requesting a demo helps answer practical questions:

- How intuitive is the interface?

- Does latency really meet promises?

- Can it handle multiple LPs without glitching?

- What happens when something goes wrong?

Trying it out can help you see if the forex bridge really works as promised and if it fits your needs before you make any decisions.

FAQ on MetaTrader bridge

It connects the MetaTrader server to external liquidity providers. When a trader places an order, fx the bridge translates it into a protocol (usually FIX), sends it to the LP, and passes the result back to MT4/MT5. It's real-time and automatic.

Any broker using MetaTrader who wants better liquidity, faster execution, and more stability should consider this solution. Small brokers relying on just one liquidity provider often struggle with pricing and execution quality. Brokers with high volume need it for better risk management, cutting bad LP flows, and minimizing slippage. Even newcomers benefit – bridges offer tighter spreads and boost client trust right from the start.

PrimeXM is known for its low latency and stable infrastructure. Tools for Brokers offers solid reporting and flexible settings. OneZero focuses on high-performance routing and strong institutional features. AzyPrime, meanwhile, balances speed, flexibility, and responsive support – a smart choice for many brokers.

FIX (Financial Information eXchange) is a protocol used to transmit trade data between financial institutions. Bridges use FIX to talk to liquidity providers. It’s fast, reliable, and an industry standard.

An API (Application Programming Interface) allows different software systems to communicate. In forex trading, APIs enable platforms to connect with liquidity providers, execute trades, retrieve market data, and more, automating processes and improving efficiency.

AzyPrime utilizes FIX API’s to ensure orders move swiftly and accurately between MetaTrader platforms and liquidity providers. The software is optimized for low latency and high throughput, managing order flow with minimal delays while offering advanced control features.