Starting a prop trading firm requires a deep understanding of the technology that drives it. What powers the system? This article outlines five critical technologies necessary for launching a prop-trading firm.

What is Prop Trading?

Proprietary trading (prop trading) occurs when a firm uses its own capital, instead of clients' funds, to trade various financial products in pursuit of profits. These companies are often called prop-trading firms or trader-funded firms (TFFs).

How Does Prop Trading Work?

Prop firm hire professional traders who employ a range of strategies, including high-frequency and algorithmic trading, to achieve profit targets.

To become a trader, individuals must pass a prop firm challenge designed to assess their trading skills and reliability. There’s typically a fee to take the challenge, and if a trader fails, they may be given additional resources or required to retake the test.

6 Key Technologies for Prop Trading Firms

Here are five essential technologies that prop trading firms need to succeed:

1. Trading Platform for Prop Firms

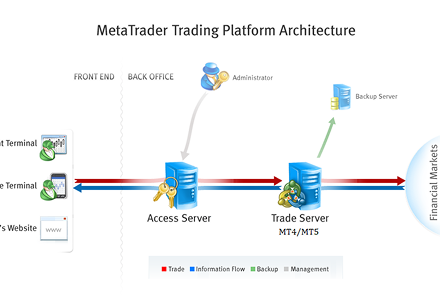

The trading platform is the most vital piece of technology for any prop firm, as it serves as the primary interface for both aspiring and funded traders. Popular platforms include MT4, and MT5.

The platform should support simulated market accounts for traders in the challenge phase and live accounts for those who have qualified. It must also allow multi-asset trading and be hosted on a low-latency network infrastructure.

The platform should offer consistent, accurate market data feeds and require high-quality execution capabilities, which can be supported by technologies like liquidity bridges or MT5 gateways. These execution engines ensure reliable trading practices that attract skilled traders.

2. Prop Trading CRM

A CRM is essential for managing the onboarding process and payment processing. A CRM tailored for financial services integrates key features such as Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

These CRMs also support various payment service providers, enabling global transactions and ensuring compliance within the financial industry. Many CRM providers nowadays provide client management services for Prop Firms. Azy Prime has extreme experience and knowledge to integrate them with trading platforms.

3. Risk Management Tools

Risk management is crucial for the smooth operation of a prop trading firm. There are numerous risks that can impact the firm's ability to manage accounts efficiently.

Automated risk management tools, can address risks like traders forgetting to set stop loss or take profit levels by setting thresholds that automatically close positions or switch accounts to read-only mode.

4. STP and Market Making

To enhance trade execution speed, reduce slippage, and generate additional revenue from the bid-ask spread, Prop firm can incorporate Straight Through Processing (STP) and Market Making.

To implement these strategies, needs skilled professionals and the right in-house technologies, such as Liquidity Bridges, which connect multiple liquidity providers to the trading platform and offer various execution models.

For new prop firms, starting with STP is a straightforward and effective approach.

5. Bonuses Campaigns

To attract more traders participate in challenges, prop firm may provide bonuses to traders. Also some loyalty programs helps increase traded volumes.

6. Report Dashboards

To monitor account health effectively, traders need real-time access to their account status, whether in live markets or during challenge phases. Most CRM vendors provide a simple, intuitive client dashboard.

Final Thoughts

Launching a prop trading firm requires a combination of technical solutions and human expertise. While the potential for profit is high, building a sustainable prop firm necessitates solid infrastructure. The technologies outlined here provide a strong foundation, but it’s the skilled traders and dedicated teams who bring these tools to life and drive success.