If you're thinking about launching a trading platform or expanding your financial services, you've probably come across two main options: white label and full brokerage. At first glance, they might seem pretty similar — but the way they work and what they demand from you can be very different.

The choice between a white label full brokerage isn’t just about tech or branding. It’s about strategy. This guide takes a closer look at both models, helping you figure out which path actually fits your goals and resources.

Understanding White Label Solutions

White label solutions have become a go-to option for businesses that want to enter the trading or investment space quickly without building everything step-by-step. Instead of developing a platform from scratch, you license a ready-made product, brand it as your own, and focus on attracting clients and growing your business. It’s a shortcut — but a strategic one. To understand how it stacks up in the white label vs full brokerage debate, let’s break it down. Below, we’ll look at the core features, the clear upsides, and where this model might hold you back.

Key Features of White Label Solutions

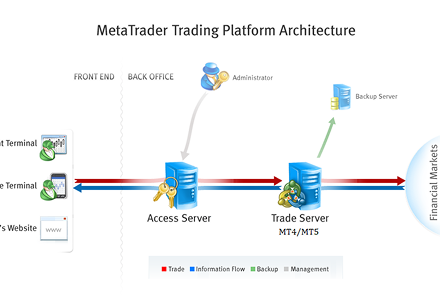

White label setup gives you access to a fully developed brokerage platform — typically including trading software, back-office tools, payment systems, and compliance infrastructure — all maintained by the provider. You can customize branding, website, client dashboards, and in some cases, certain aspects of the platform’s functionality.

You’re not starting from zero:

- trading platform (web and mobile);

- CRM and client management systems;

- risk and compliance tools;

- multi-language and multi-currency support;

- integration with liquidity providers and payment gateways.

Basically, you’re leasing a business-in-a-box — one that lets you get to market in a matter of weeks, not months.

Advantages of White Label

The most important advantage? Speed. You can launch fast, skip most of the development headaches, and lean on the expertise of a tech provider who’s already done this many times. It’s also cost-effective compared to building a brokerage from scratch.

Other benefits include:

- lower upfront investment;

- minimal technical knowledge required;

- ongoing tech and support handled by the provider;

- scalable model, ideal for testing new markets.

For startups and smaller firms, this is often the fastest way to get in the game.

Limitations of White Label

But there are trade-offs. You’re working within someone else’s framework, which limits how much you can customize or innovate. You're also dependent on your provider for updates, reliability, and support.

Common limitations include:

- limited control over platform features;

- shared infrastructure with other clients;

- ongoing fees and revenue sharing;

- potential branding limitations.

In the white label and full brokerage comparison, white label wins on speed and simplicity, but it’s not always the right long-term solution, especially if full control and deep customization are part of your vision.

What Is Full Brokerage?

Full brokerage is what it sounds like: you're building and running the entire operation yourself. No shortcuts, no rented platforms — everything from the trading infrastructure to compliance, customer support, liquidity, risk management, and marketing is under your control. It's a much bigger commitment than a white label setup, but it also gives you much more freedom.

In the white label vs full brokerage comparison, full brokerage is the heavyweight. It’s a long-term play for companies that want to create something unique, scale aggressively, and control every aspect of the user experience. But of course, with great power comes… well, a lot of responsibility.

Key Features of Full Brokerage

Full brokerage gives you complete ownership over your platform and operations. That includes the tech stack, licensing, financial infrastructure, and customer relationship management. You're not just selling access to markets — you're the one providing it.

Here’s what’s typically included:

- Custom-built or fully-owned trading platforms.

- Direct relationships with liquidity providers and market makers

- In-house risk management, KYC/AML, and compliance.

- Regulatory licenses and legal structure.

- Full branding, UX/UI control, and feature development.

- Internal support, dealing desk, and back-office systems.

This model gives you the power to build a brokerage business exactly how you want — no compromises.

Advantages of Full Brokerage

The biggest benefit? Independence. You’re not tied to another company’s roadmap or limitations. You choose the features, you set the spreads, you define the customer experience. That level of control is crucial if you’re aiming to be a major player or offer something truly different.

Other pros include:

- full revenue ownership (no sharing with a provider);

- deep customization of tools and features;

- ability to innovate and build proprietary technology;

- direct relationships with clients, partners, and regulators;

- higher brand authority and trust over time.

For businesses with a clear long-term vision, this model opens the door to real growth and differentiation.

Challenges of Full Brokerage

Of course, it’s not all upside. Building a full brokerage from scratch takes time, money, and expertise. Regulatory hurdles can be serious, and the technical side — from platform stability to cybersecurity — is problematic.

Common challenges include:

- High upfront costs and ongoing operational expenses.

- Long time-to-market (often several months or more).

- Need for in-house legal, compliance, and tech teams.

- Complex licensing across different jurisdictions.

- Constant infrastructure maintenance and updates.

So while full brokerage offers more freedom than white label, it also demands a lot more in return. When looking at a full brokerage white label, the decision often comes down to how much risk and responsibility you're ready to take on — and how quickly you need to get to market.

White Label vs. Full Brokerage: Key Comparison

Let’s put them side by side. The full brokerage vs white label decision is really a trade-off between control and convenience, speed and scale, cost and customization.

|

Feature |

White Label |

Full Brokerage |

|

Setup Time |

Weeks |

Months (sometimes longer) |

|

Upfront Cost |

Low to moderate |

High |

|

Technical Responsibility |

Mostly on the provider |

Fully on you |

|

Customization |

Limited |

Full control |

|

Regulatory Setup |

Often provided or simplified |

You handle everything |

|

Revenue Ownership |

Shared |

100% yours |

|

Scalability |

Moderate |

High (if well-built) |

|

Time to Market |

Fast |

Slower but strategic |

White label gives you a fast-track option with lower risk, perfect for testing ideas, entering new markets, or operating with limited resources. Full brokerage, meanwhile, is a long-term investment. It’s about building something from the ground up, owning every piece of it, and making no compromises.

But here’s the thing — neither model is automatically better. The winner in the white label vs full brokerage matchup depends entirely on your goals, your budget, and how involved you want to be in the day-to-day operations.

Which Option is Right for You?

Ask yourself a few questions:

- Do you want to launch quickly with minimal technical hassle?

- Are you okay with sharing revenue and working within someone else’s framework?

- Do you have the capital, the team, and the vision to build something from scratch?

If speed, simplicity, and low upfront investment are what you need, white label is likely the smarter move, especially if you're just starting out or exploring a new niche. It’s a great way to get your brand out there, gain clients, and validate your concept.

On the other hand, if you have a long-term plan, have access to funding, and want full autonomy, full brokerage might be the way to go. Yes, it’s a bigger challenge. But the payoff — full revenue, total control, and brand strength — can be worth it if you’re ready to commit.

Conclusion

Thus, the full brokerage vs white label decision isn’t just about technology. It’s about strategy. You’re choosing how your business will grow, what kind of risk you're willing to take, and how much control you want over the journey. So choose the model that fits your ambition and reap the benefits!